Simply better borrowing experiences

Attract and retain customers with intuitive, immediate, omnichannel lending.

When it comes to lending, you can’t compete on price alone—in fact, a lot of borrowers choose higher-interest lenders simply because they’re faster and easier to work with. At the end of the day, people borrow money to improve their lives; a streamlined, digital lending process builds confidence that you’re the right bank to serve as their agent of change.

With the right solution, you can help borrowers transform their lives.

Here’s how.

PROVIDE SIMPLER EXPERIENCES

When your customers need a loan, they need it now.

Don’t make them wait and don’t put yourself at risk by rushing through manual or disparate processes.

Make borrowing quick and simple

Borrowing shouldn’t be complicated, but it often is. With automation and configurable workflows, you can offer an intuitive, step-by-step information gathering experience that leads to quick applications and almost instant decisioning. With repeatable, automated loan processes, your business can handle application volumes of 3X your historic levels without adding staff or compromising lending standards.

Compete on experience

Our modular platform gives you the ability to manage lending simply throughout the entire loan lifecycle, from application to collections. The result is a better experience for both borrowers and lenders. With the right technology, you can win customers by providing a compelling experience, even where you’re not offering the lowest rate.

AGILE AND SCALABLE TECHNOLOGY

Seamless onboarding and servicing Instant decisioning Automated, configurable workflows End-to-end lending Native Salesforce build

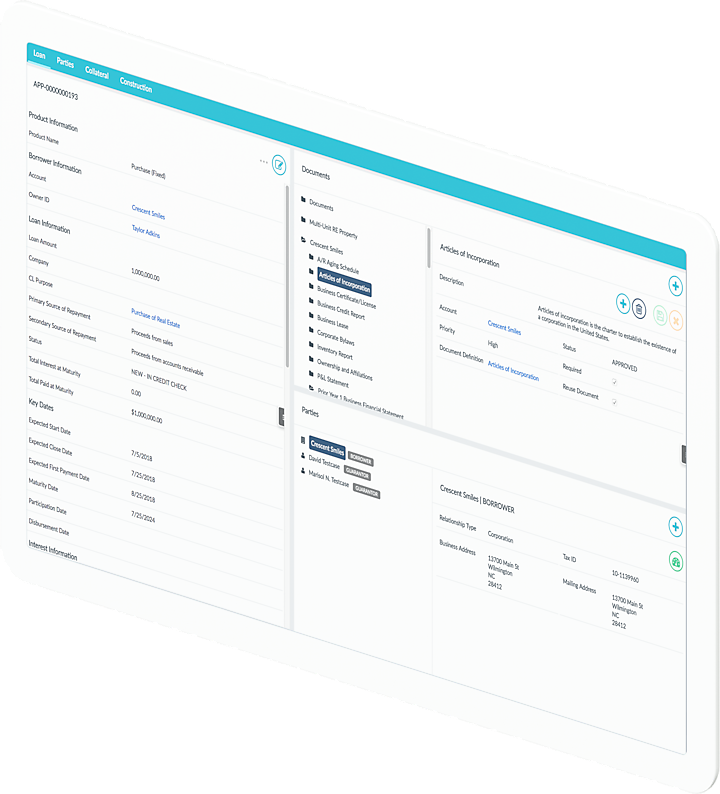

Create exceptional and seamless borrowing experiences with our highly configurable, feature-rich lending software.

-

CL Portal

Create great borrowing experiences with quickly configurable workflows and automated processes.

-

PRODUCT OVERVIEW

CL Marketplace

Expand your presence in online marketplace lending with an automated, comprehensive loan management tools.

-

CL loan

Improve borrower experiences at scale with automated, cloud-based lending.

-

CL Collections

Maximize revenue with automated, agile, cloud-based collection processes.

-

CL Originate

Increase productivity and lower origination costs with auto-decisioning and compliance checklists.

We saw all the [lending] systems; most of them have only digitalised the paper process. [Q2’s] was the only one born to APIs and this changes the game. We were able to go to market with speed and the turnaround time for loan contracts is down to minutes, all in a completely digitised workflow.

Origination made easy

Our leasing solution can be integrated with either your existing origination platform or our in-house origination and underwriting platform. With our solution, you’ll be able to set up online leasing portals and automate origination by gathering decisioning data from multiple sources and automatically generating contracts for e-signatures.

Integrate collections

Our modular approach to leasing and lending lets you plug into our agile collections solution, creating a seamless integration between collections and the rest of your leasing workflow. You’ll be able to simply define and automate your collections process, ensure your compliance team adheres to regulations, and provide a consistent lessee experience from start to finish.

BUT THIS IS JUST THE BEGINNING

Consumer Lending is just one piece of a comprehensive consumer solution set. Effectively serve account holders and transform their lives with our other consumer solution set.

We can help you make it simple, fast, and inexpensive to win new customers, generate additional revenue, and build more rewarding customer relationships.

Let’s build something better.

Let’s do this.

Or call 1-833-444-3469