Q2 COLLECTIONS ™

Maximize revenue with automated collection strategies

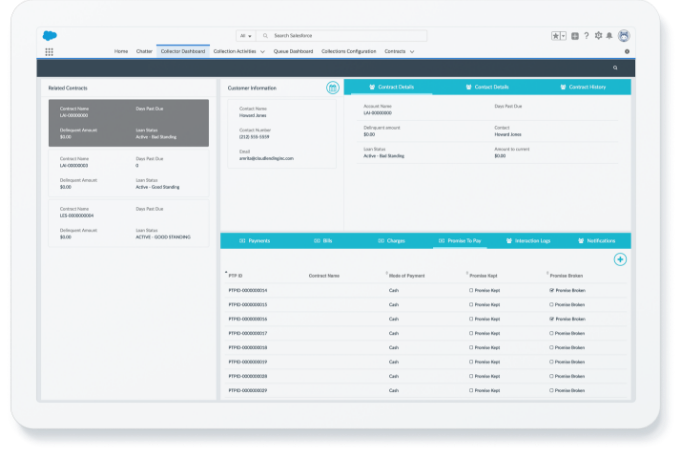

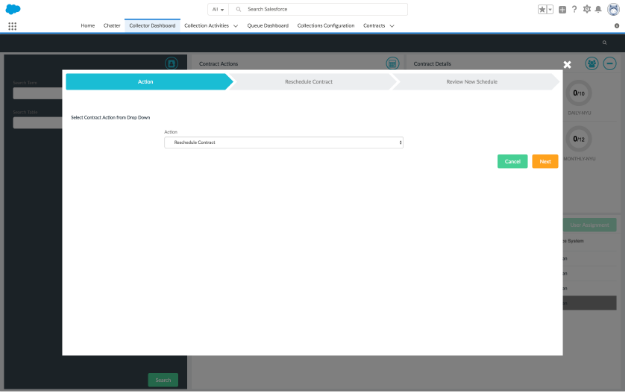

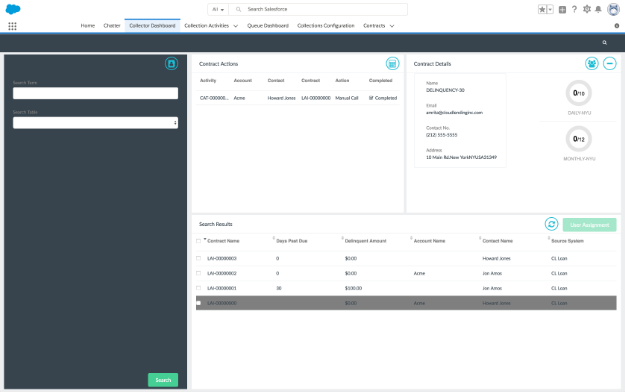

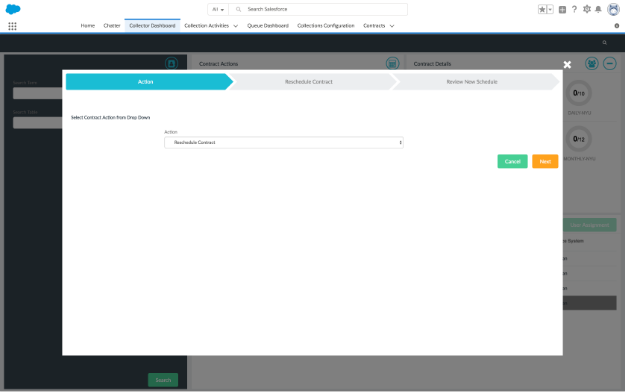

Give collectors the right tools and priorities to contact borrowers successfully

Leave behind old collection methods to jumpstart your growth

Manual and outdated technology can’t keep up with the rising demands of modern lending. By embracing metrics tracking and automation, CL Collections™ offers the architecture necessary for successful loan collection.

KEY BENEFITS

LOWER COST AND EFFORT

By using automation and an agile, configurable approach to manage the collections workflow, you reduce your project management resource load.ELIMINATE SERVICING ERRORS

Remove the chance of personal error by automatically recording all billing and collection interactions.OPTIMIZE BORROWER INTERACTIONS

By contacting borrowers in their preferred method and fine-tuning strategies based on useful data, you’ll gain better interactions and greater return per contact.

We saw all the [lending] systems; most of them have only digitalised the paper process. [Q2’s] was the only one born to APIs and this changes the game. We were able to go to market with speed and the turnaround time for loan contracts is down to minutes, all in a completely digitised workflow.

HOW IT WORKS

A single system of record

Manage every step of the lending cycle on a single, cloud-based system, including origination, underwriting, servicing, and collection.

Built natively on Salesforce

Integrate with thousands of other enterprise applications as you grow.

Enterprise-class security

As an AICPA SOC2 Type II certified company, protecting customer data is our #1 priority.